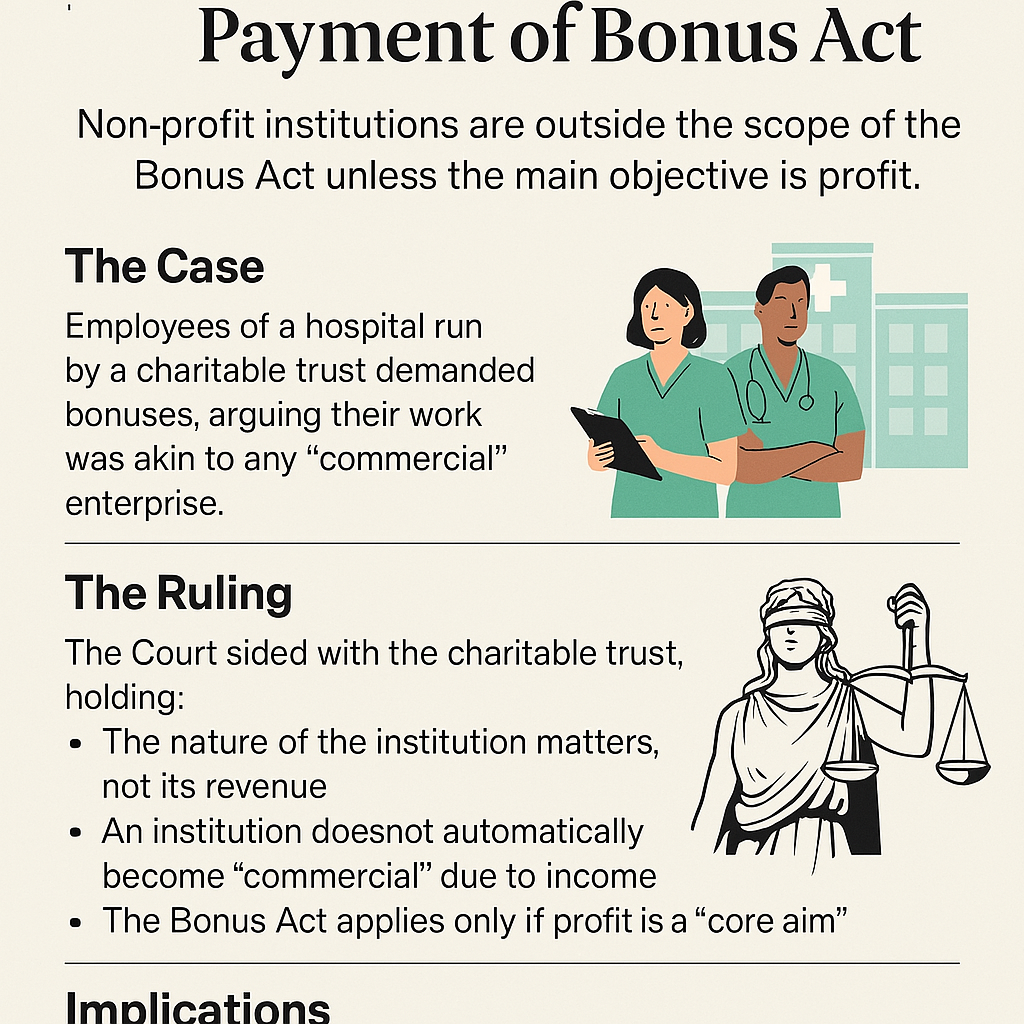

Supreme Court's Judgment: Bonus Act Not Mandatory for Charitable Trusts

In a landmark ruling delivered in March 2025, the Supreme Court of India addressed a longstanding legal ambiguity regarding the applicability of the Payment of Bonus Act, 1965, to employees working in institutions run by charitable trusts. The Court held that unless such institutions operate as “establishments” with profit as a primary motive, they are not obligated to pay annual bonuses under the Act.

The Case: Hospital Employees vs. Charitable Trust

The case arose from a dispute involving employees of a non-profit hospital operated by a charitable trust. The employees filed a petition seeking bonus payments, arguing that despite being a charitable institution, the hospital generated substantial income through patient services and operated similarly to commercial establishments.

The trust, however, countered the claim with a three-fold defense:

1. Charitable status – It operated as a public charitable trust, registered under the applicable law and exempt from income tax.

2. Reinvestment in services – All earnings were reinvested into providing better patient care, infrastructure, and medical outreach programs.

3. Non-commercial intent – The institution’s foundational documents and activities demonstrated a clear absence of any profit-oriented objective.

What the Supreme Court Held

The Supreme Court bench, after analyzing the structure and objectives of the trust, ruled in favor of the institution. In its detailed judgment, the Court emphasized the purpose behind the operation of an organization rather than the presence of revenue.

Key observations from the ruling include:

• Purpose over Profit: The mere fact that an institution earns revenue does not make it a commercial enterprise. What matters is whether the intent behind its activities is to generate and distribute profit.

• Scope of the Bonus Act: The Payment of Bonus Act, 1965, is explicitly applicable to profit-making establishments. The legislation was framed to ensure a fair share of profits is distributed to employees in sectors focused on commercial gain.

• Charitable institutions are distinct: The Court reiterated that hospitals, schools, and other services run by trusts or NGOs for public welfare, with no dividend or profit-sharing mechanism, cannot be equated with for-profit enterprises.

Implications of the Ruling

The ruling is significant for several reasons:

1. Legal Clarity for the Non-Profit Sector: The verdict offers clear legal guidance on the bonus obligations of NGOs, educational institutions, religious trusts, and hospitals that do not operate with a profit motive.

2. Employee Expectations: Workers employed in charitable organizations may no longer expect annual bonuses unless the law is amended to specifically include non-profit organizations within its scope.

3. Precedent for Future Cases: This decision sets a binding precedent that will be cited in future litigation involving employees of charitable organizations seeking monetary benefits typically provided in the corporate sector.

Possibility for Legislative Change?

While the judgment reaffirms the spirit of the Payment of Bonus Act, some legal experts argue that the evolving nature of the non-profit ecosystem—particularly large institutions generating significant revenues—might necessitate a re-examination of labor protections for employees working in such sectors.

For now, however, the ruling makes it legally clear: Charitable trusts that do not exist to make profits are not bound by the Payment of Bonus Act, 1965.

comments