Delhi High Court Orders Strict Regulation of “Buy Now, Pay Later” Loan Apps

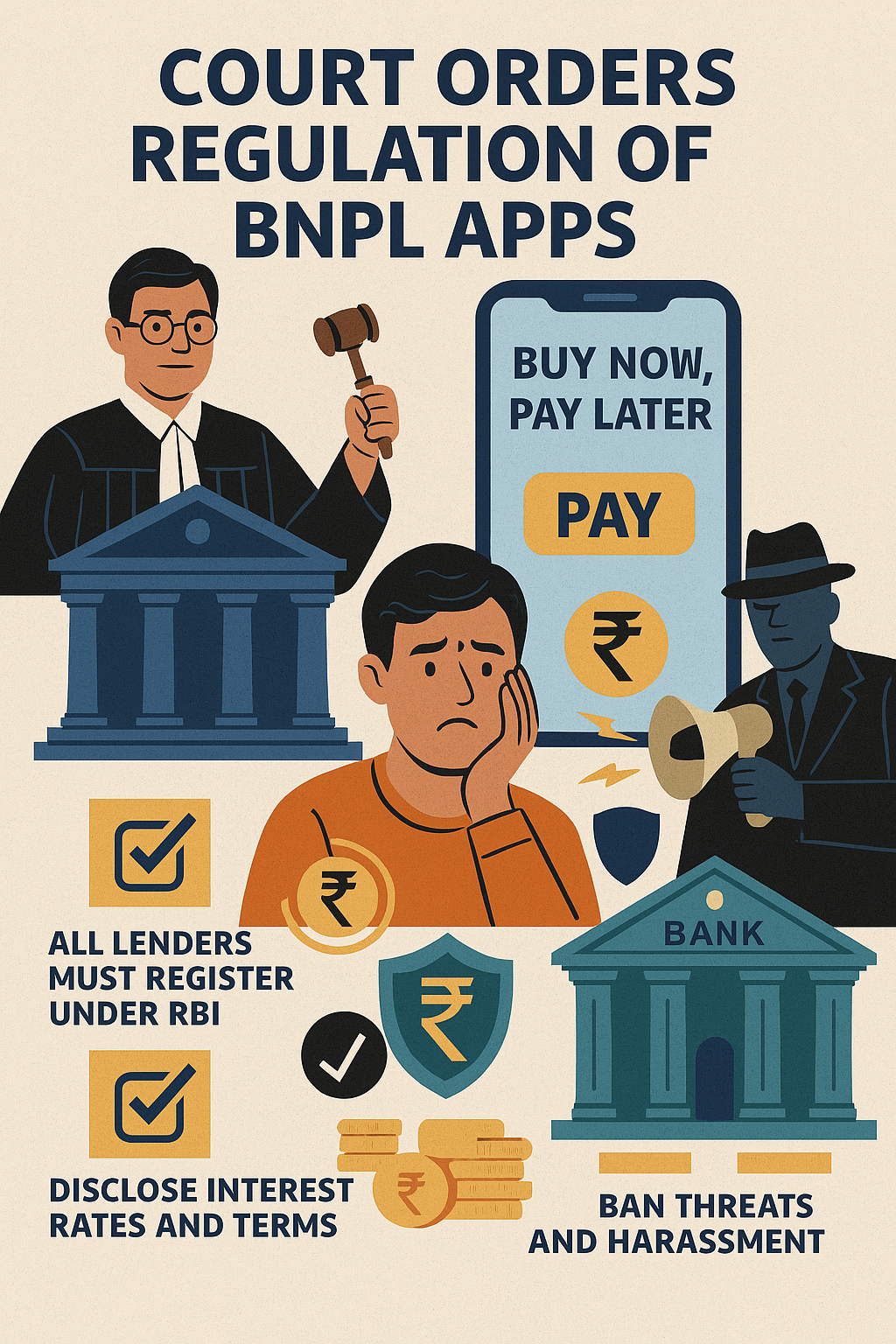

In a move hailed as a major win for consumer financial rights, the Delhi High Court has taken a significant step toward regulating India’s rapidly growing “Buy Now, Pay Later” (BNPL) sector. Responding to mounting public complaints and legal petitions, the Court has directed the Reserve Bank of India (RBI) to impose stringent regulatory measures on BNPL platforms, many of which currently operate outside the purview of India’s formal financial system.

The Rise—and Risk—of BNPL in India

Over the past few years, BNPL services have exploded across India’s digital economy. Marketed as a convenient alternative to traditional credit cards, BNPL apps allow users to purchase goods and services instantly and pay later, often in installments.

However, beneath the glossy advertising and frictionless payments lies a growing concern: many BNPL companies function without RBI registration, do not disclose true borrowing costs, and employ aggressive debt recovery practices. These shortcomings have resulted in significant financial distress for unsuspecting users, many of whom fall into spiraling debt traps due to hidden fees and exorbitant interest rates.

The Legal Challenge That Sparked Reform

The case that prompted this judicial intervention was filed by a consumer rights advocacy group, highlighting how several digital lending platforms had harassed borrowers, levied undisclosed penalties, and bypassed all forms of regulatory oversight.

The court heard testimonies from individuals who had taken small BNPL loans and were later subjected to aggressive recovery tactics—including threatening calls, public shaming, and even extortion. In many cases, users were unaware that they had agreed to high-interest terms, due to vague or misleading terms and conditions buried deep within mobile app interfaces.

Delhi High Court’s Directive to the RBI

In a strongly worded judgment, the Delhi High Court observed that:

• BNPL cannot remain a regulatory grey area: Financial services, whether traditional or digital, must be held to the same consumer protection standards.

• Consumers deserve full transparency: BNPL providers must clearly disclose interest rates, penalties, repayment schedules, and late fees.

• RBI must step in immediately: The central bank has been asked to draft a regulatory framework that treats BNPL providers as non-banking financial companies (NBFCs), subjecting them to the same compliance, audit, and lending standards as other financial entities.

The Court further ordered that all BNPL companies must be registered and monitored by the RBI and that their partner debt collection agencies must adopt ethical recovery practices—strictly prohibiting any form of harassment, intimidation, or misuse of borrower data.

Impact on Consumers and the Fintech Sector

This ruling has wide-ranging implications for both consumers and the burgeoning fintech industry:

• Consumer Protection First: Borrowers will now have legal recourse if they are misled, overcharged, or harassed.

• Fintech Accountability: BNPL platforms, once lauded for innovation, will now have to build robust compliance systems and rethink their business models.

• Standardization of Lending Practices: With RBI oversight, interest rates and repayment structures will become more consistent and fair across the digital credit sector.

Industry insiders believe that while this may initially create compliance pressure on BNPL startups, it will ultimately foster trust and credibility in the digital lending space—paving the way for responsible innovation.

The Bigger Picture

India is currently the world’s fastest-growing digital lending market. As mobile-first users turn to BNPL apps for everything from groceries to smartphones, ensuring financial literacy and consumer safety is more critical than ever.

The Delhi High Court’s intervention sets a strong legal precedent, pushing regulators to catch up with technology and protect the most vulnerable users in the digital economy. With this ruling, India takes a decisive step toward a more transparent, fair, and accountable financial future.

comments